Are you eying a dream house or vehicle? Considering taking out a loan to fund it?

Sure, you should consider taking a moment to pause since various banks apply differing debt service ratio (DSR) thresholds. Therefore, it would be wise to conduct some preliminary investigation to prevent having your housing loan application turned down.

What does debt service ratio mean?

Source: BNM

Initially, DSR appears quite straightforward to explain. It represents the percentage of your household income allocated towards repaying debts. Essentially, it serves as an indicator of how well someone can handle and clear their financial obligations.

There is

growing concern

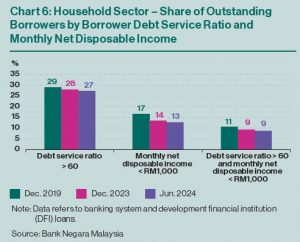

Many Malaysians allocate a significant portion of their household earnings towards repaying debts. As of 2019, approximately 30% of Malaysians had a debt service ratio exceeding 60%.

These elevated DSR levels for home loan holders caused concern amongst legislators regarding the potential risk of Malaysians facing financial distress due to factors such as rising interest rates, unemployment, or inflation.

By 2024, the percentage of borrowers with a Debt Service Ratio exceeding 60% has dropped to 27%, indicating that more than one-quarter of Malaysian families remain vulnerable.

What makes maintaining more than 60% DSR potentially dangerous? What connection exists between this and your monthly disposable income? Grasping their relationship is key.

It plays a crucial role in maintaining your overall financial well-being. Your DSR is among the three primary elements influencing your borrowing risk profile.

What constitutes a favorable Delivery Success Rate?

If you’re looking to acquire new real estate, your Debt Service Ratio (DSR) should typically not go beyond 30%.

Although this is generally accepted as a guideline rather than an unbreakable rule, banks tend to be highly reluctant when it comes to favoring applicants who surpass this threshold. Certain banks might make exceptions for borrowers exceeding these limits, but such cases are rare.

Up to 70% DSR ratings

However, this represents the far end of the scale since it’s highly perilous to allocate such a significant portion of your income towards loan repayments. For safety, it would be best to maintain your Debt Service Ratio (DSR) around 30%.

Banks use your Debt Service Ratio (DSR) to assess what portion of your income goes toward repaying debts and fulfilling other financial responsibilities. This ratio is also employed for

assess whether your current standing is sufficiently strong

To be able to manage the housing loan you are applying for.

A low DSR indicates to banks that you are less likely to face difficulties repaying your monthly installments promptly and that the chance of you failing to make these payments is relatively small.

Calculating your DSR

Calculating your DSR is quite simple. You just need to divide your monthly debt obligations by your net income. The result is typically shown as a percentage.

DSR % = Debt ÷ Net Income X 100

Debt encompasses the sum of all your current monetary debts. This may consist of payments for credit cards, personal loans, and student loans. Conversely, net income pertains to your earnings post-deductions, including items like income tax and EPF contributions.

Suppose your family earns RM8,000 each month (this could either come from one individual working professionally or as an aggregate salary for a duo). Once you subtract contributions towards EPF, taxes, and SOCSO, your take-home pay would roughly amount to RM6,500.

Hence, to achieve a Debt Service Ratio (DSR) of 30%, your family’s overall debt should not go beyond RM1,950.

DSR of 30% = (RM1,950 / RM6,500) × 100

Let us now suppose that your monthly financial commitments include the following:

Car loan: RM500

Credit card repayments: RM400

PTPTN Loan: RM100

Total

financial debt = RM1,000

Therefore, if your total household income is RM8,000 and your net income amounts to around RM6,500, the monthly mortgage payment for a new home loan ought not to exceed RM950.

What impact will DSR have on your eligibility for a home loan?

The highest debt service ratio threshold can differ significantly between various banks. Additionally, even with the same banking institution, distinct rules might apply based on the type of loan you’re seeking, leading to varied DSR criteria.

If you’re a first-time homebuyer, you’ll likely find yourself in a favorable position with a Debt Service Ratio (DSR) below 30%. You definitely wouldn’t want to allocate nearly your entire income towards housing costs, thus leaving little to no room for saving money.

If you remain uncertain about what you’re stepping into, you have the option to utilize

GenZ Space’s housing loan calculator

To compute your monthly payments, interest fees, and additional specifics yourself.

Improving your DSR

The lower your DSR, the better! To stay on the safer side, aim to maintain your DSR at a minimum level. By doing this, you significantly reduce the chance of accumulating rejected loan applications. There are two main approaches to enhancing your DSR.

Reducing your debt

The simplest approach is to decrease your expenditures to lower your overall debt or figure out a method to boost your net earnings. To lessen your debt, consider pinpointing non-essential credit card expenses and trim them back to improve your Debt Service Ratio (DSR). Additionally, do not overlook the repayment of non-bank loans because financial institutions view these payments similarly to those from bank debts.

You might want to think about using

debt consolidation

to lower your monthly installments.

Increasing your net income

Boosting your net income can be somewhat more challenging, as it involves finding an additional revenue stream or pursuing a salary increase at work. If you’re uncertain about how to begin, we can offer some assistance.

basic overview including several suggestions on how to approach requesting a promotion

.

Combined income with spouse

Another method to improve your DSR is by combining your income as “joint purchasers” with a spouse or partner in your loan submission. However, make sure that the both of you fully understand your individual legal rights as joint-purchasers.

Understand your DSR before taking on additional debt

In summary, before applying for a new home loan, make sure to determine your Debt Service Ratio (DSR) first. Assess your net income, expenditures, and cumulative debts so as to gauge how much you can afford to pay towards installments without strain. Additionally, conduct thorough investigations to identify which banks offer the most suitable loan options aligning with your overall financial standing and DSR. By keeping these points in consideration, you should be able to sidestep potential rejections of your loan application.

Read More:

What Is The Process For Determining The Cost Of A Home You Can Manage?

What Is the Cost of Affordable Housing in Malaysia?

The article was last updated on March 20, 2025.

The post

What Does Debt Service Ratio (DSR) Mean and How Do You Calculate It?

appeared first on

GenZ SpaceMalaysia

.